Lenders take a number of things into consideration when evaluating a VA loan application. While there isn’t a credit score requirement for participation in the VA loan program many lenders want to see scores north of 620, and at Benchmark Mortgage this number is 580 to move forward with a loan.

There are other factors that play into this as well: a prospective borrower must also meet the VA standards for debt-to-income ratio and residual income.

Debt -to income ratio guidelines have no maximum, however, the lender must provide compensating factors for debt ratios over 41%.

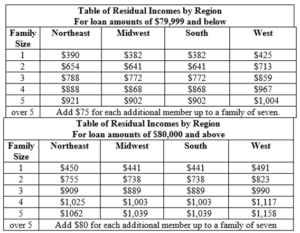

Residual income requirements are as follows:

If you face credit problems and do not qualify upfront we are happy to guide you in a process to improve your credit and reach that dream of home ownership.

Some may find these DTI factors easy to achieve and still have plenty left over to appease the residual income requirements and others may not. That does not mean there is no reason to hold hope. Borderline DTI ratios may still be workable.

Compensating Factors

When DTI and/or Residual Income requirements are leaning more in the direction of the VA margins, lenders can take a look at things called Compensating Factors.

For a VA loan application Compensating Factors include:

- Excellent credit history

- Minimal debt

- long-term employment

- Military Benefits

- Conservative credit use

- Liquid assets

- As well as many others

While these factors may help it is noted by the VA that these factors must go well beyond what would typically be considered a requirement by the VA loan program. Many veterans and active duty service members benefit from compensating factors.

Be aware that the VA does not allow compensating factors to counteract bad credit.

Negative Factors

While your DTI and/or Residual Income may be within margins for qualification, other factors can hurt your loan application.

Those negative factors are:

- Late Payments

- Previous Bankruptcies

- Foreclosures

These factors do not bar you from loan qualification but they can cause lenders that you are a risky investment.

****If ever you are having issues or need help with VA loan questions call the toll-free number to speak directly with a VA loan Technician 1-877-827-3702

https://www.benefits.va.gov/WARMS/docs/admin26/pamphlet/pam26_7/ch04.doc